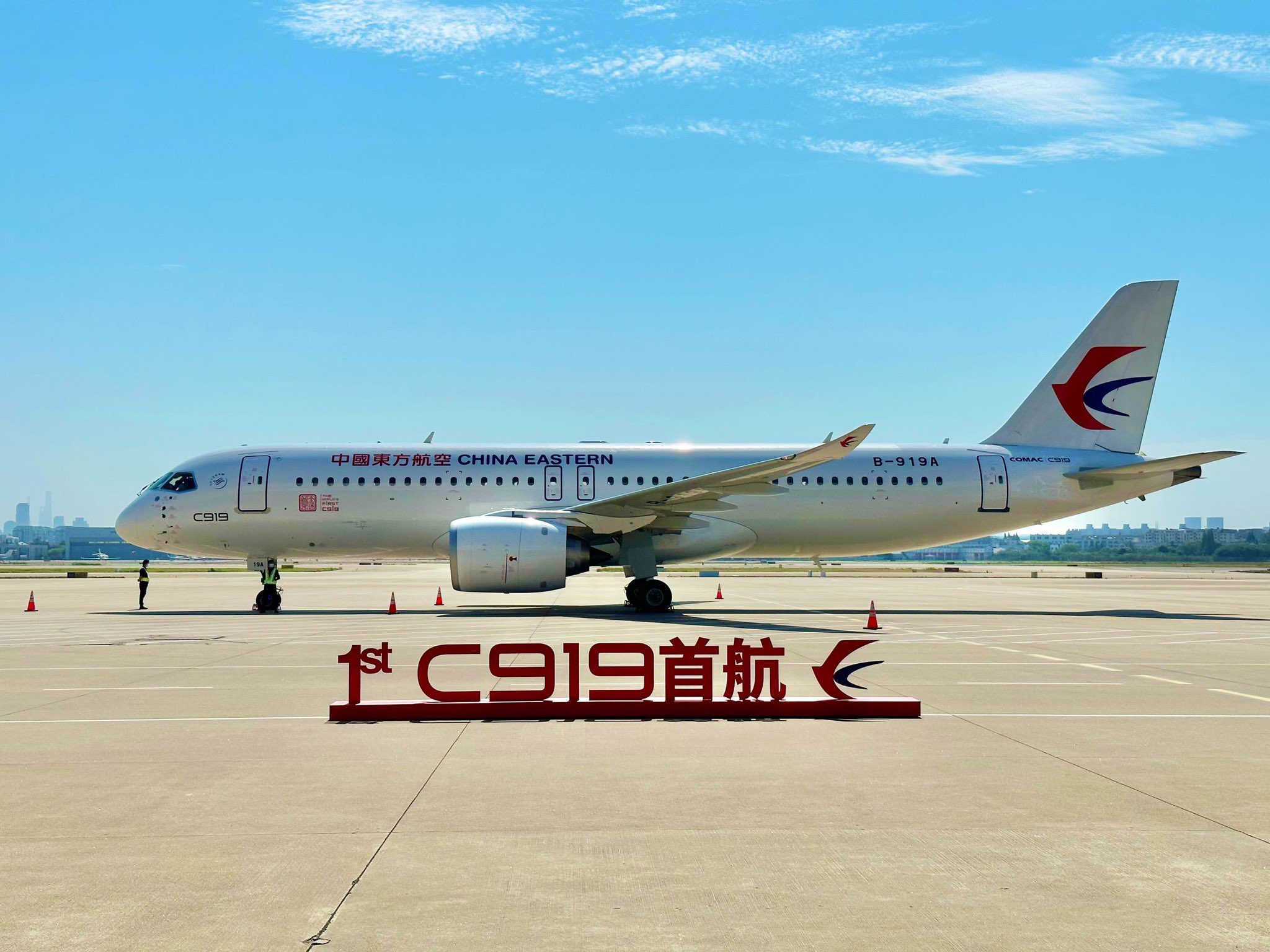

News is emerging from Asia that Air China has ordered 100 C919s in a deal valued at $10.8 billion...

Airbus

Airbus announced lower-than-expected operating profits and cash flow. The OEM had previously announced hiring more staff to prepare for...

Ending years of speculation, IndiGo, the Delhi-based low-cost airline, on Thursday placed a firm order for 30 A350-900 aircraft...

Airbus PR — Airbus announced that C. Jeffrey Knittel is retiring as Chairman and Chief Executive Officer of Airbus...

These are tough times for the aerospace supply chain. However, it should be good times—orders are great, and backlogs...

The delivery numbers are in for the period. A delivery is when the OEM gets paid in full for...