Taiwan’s STARLUX Airlines ordered five Airbus A350F freighters and three more A330neo widebody aircraft at the Singapore Airshow, marking...

A330neo

Airbus PR — Since its first delivery in November 2018 and with over 120 aircraft in service today, the...

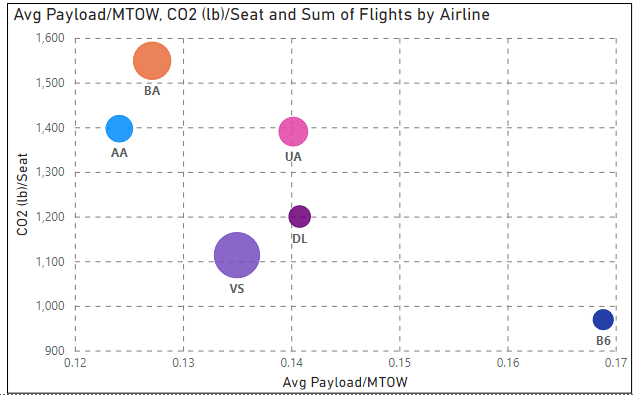

Environmental Efficiency and “Horses for Courses”

The Brazilian carrier Azul Linhas Aéreas and Airbus announced on Wednesday they have signed a firm order for three...

Is the A330 the best twin-aisle Airbus has made?

Airbus A330neo is the sleeper in the range