Boeing’s problems are getting worse. The MAX is grounded, the 787 is being investigated for quality issues and has...

737NG+

Just when we thought the spate of Boeing 737 news last week was over, several new items broke over...

News Another problem has emerged for Boeing, this time for both the 737MAX and 737NG aircraft. Boeing has discovered...

News The FAA is now apparently investigating the handling of the 737NG in addition to the handling of the...

Boeing has an image problem with GoldCare. If you asked most people in the industry what GoldCare is, they...

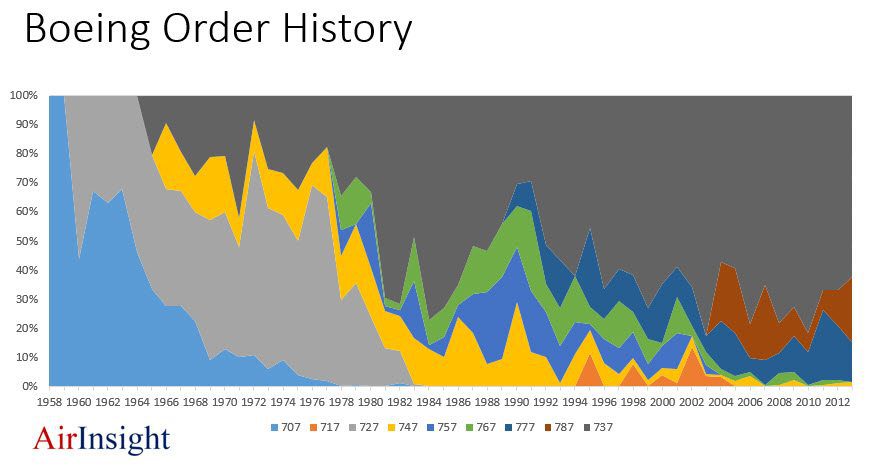

Commercial aerospace is a long run business. The gestation of new programs takes years. Of late, add a few...