Here’s our updated model. Notes: February +3% YOY and 6% ahead of 2019 levels In aircraft terms, large cabin...

General Category

General Dynamics reported increased earnings in the fourth quarter. They saw growth across its businesses. The company even noted...

A few days ago, Ampaire took its hybrid-electric Caravan demonstrator on a fantastic mission. Ampaire believes the flight established...

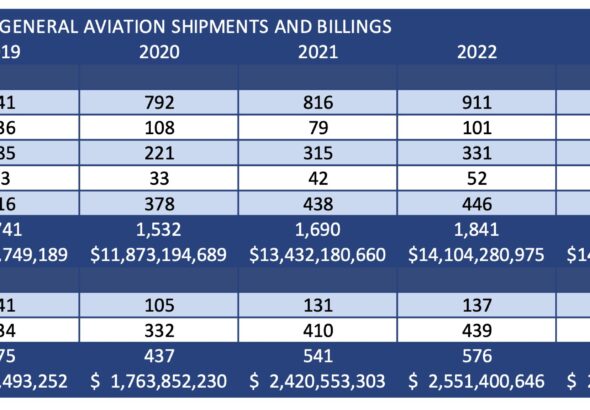

GAMA, the General Aviation Manufacturers Association, released its third-quarter shipments and billings report last week. The report reveals that...

The October data has been published, and here’s our updated model. Subscriber content – Sign in Subscribe ...

The FAA published its business jet report through the end of September. Here’s our updated model of their data....