Aeroflot ordered 50 MC-21s today from IRKUT. Aeroflot will receive the first jet in the first quarter of 2020,...

UEC

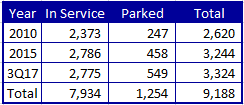

Turboprops have had a good year in 2017. We take a look at the market and provide some insights...

Rostec reports today: “The United Engine Corporation (UEC, part of Rostec State Corporation), as part of Aviation Expo China...

In a world moving towards big twins, Russia’s Frigate has decided to move to quad power. As Alexader...

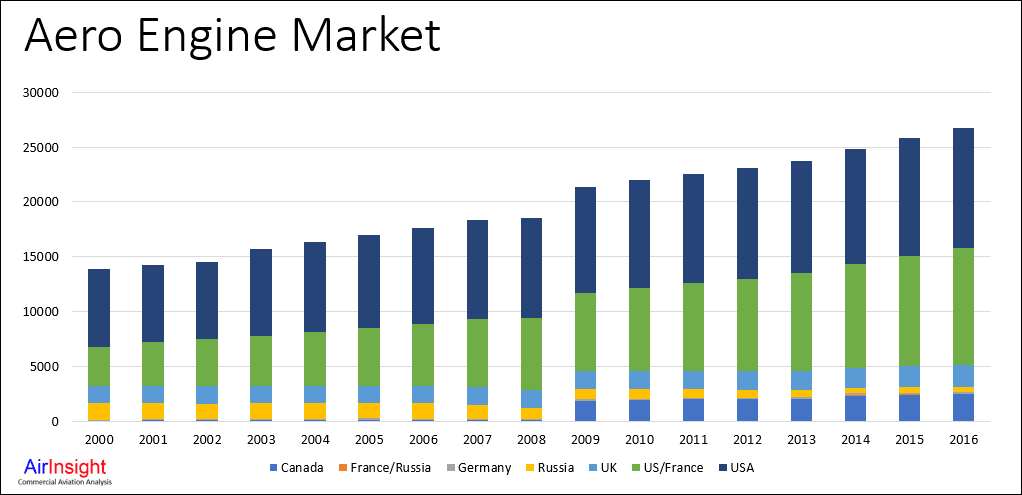

In a quick review of the market, we can see how the engine market has grown in sympathy with...

United Engine Corporation, part of Russia’s Rostec State Corporation, announced plans to upgrade its production facilities between 2017-2025 to...