Two new models, the midsize Preator 500 and super-midsize Preator 600 were introduced by Embraer today just prior to...

Honeywell

Boeing claimed a victory from the latest round of WTO rulings – Airbus, of course, differed in their interpretation. ...

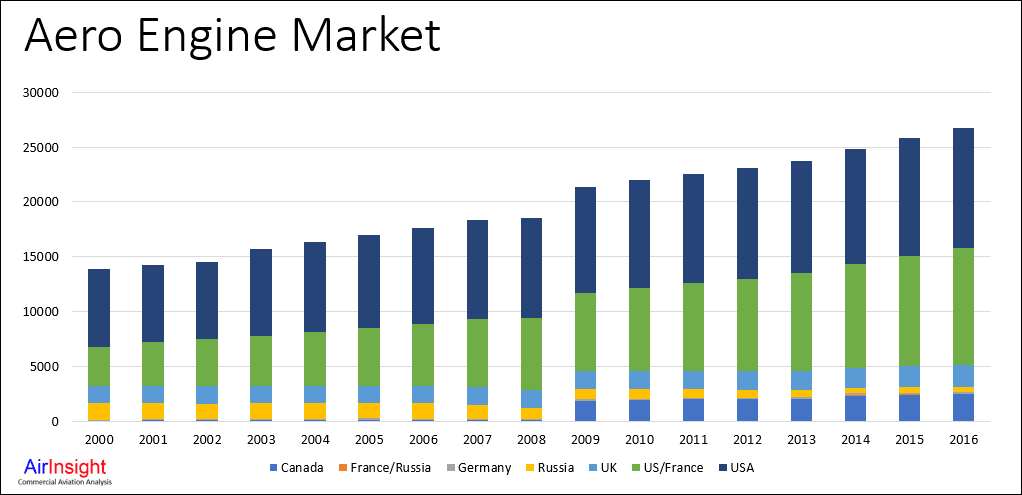

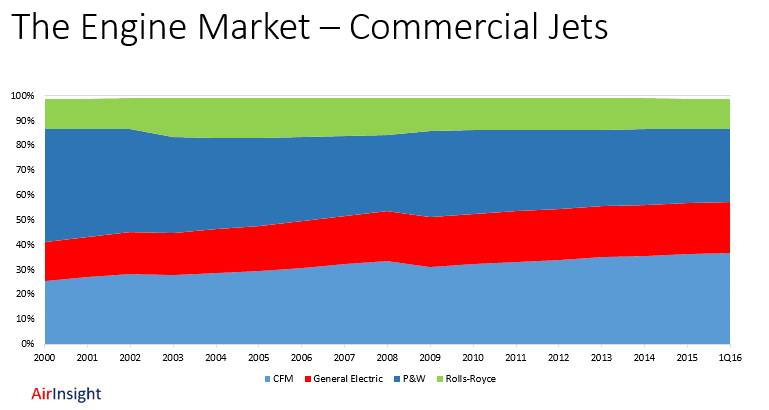

In a quick review of the market, we can see how the engine market has grown in sympathy with...

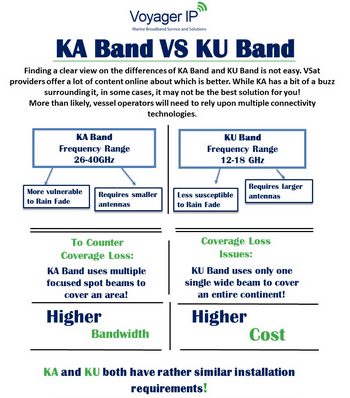

We have been tracking demand for aircraft connectivity for some time. There are several news stories that further underscore...

In about ten minutes, National Agricultural Aviation Association Executive Director Andrew Moore explains how important this industry is. It...

Rolls-Royce has seen its stock price swing a lot in recent times. The company is a leading aero-engine maker...