Ahead of tomorrow’s investor day, GE’s aerospace unit reinforced its 2024 financial targets while authorizing up to $15 billion...

General Electric

The air show gets all the attention, but once the show is over, what remains? It appears that big things...

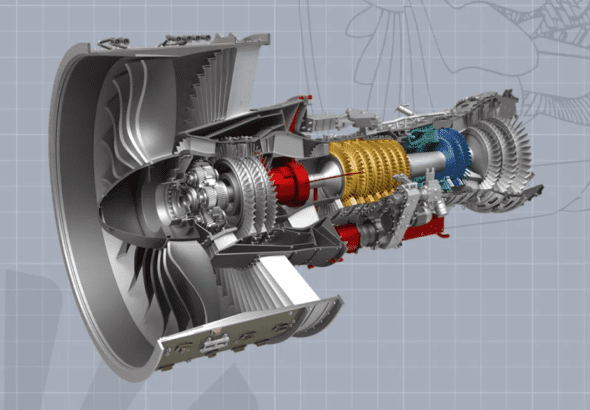

GE Aerospace can look back on a strong 2023. The engine maker recorded a 22 percent increase in orders...

Safran Aircraft Engines has officially started a new four-year wind tunnel test program of an open rotor concept. The...

GE Aerospace has been awarded a contract by NASA for Phase 2 of the so-called HyTEC program, which stands for...

UPDATE – GE Aerospace benefitted from strong demand for new commercial engines and services, reporting a 25-percent growth of...