We have been tracking demand for aircraft connectivity for some time. There are several news stories that further underscore...

Inmarsat

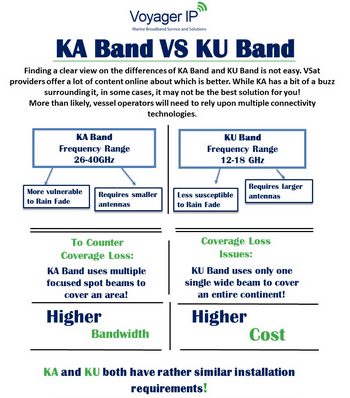

The airline industry seems to be pushing for ever more bandwidth on their aircraft. An early pioneer in this...

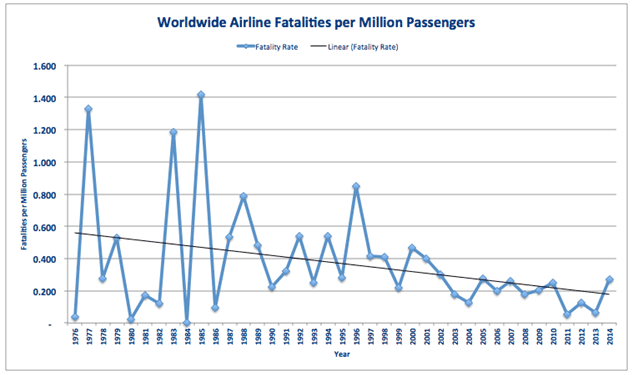

Air travel is a very safe mode of travel, with few accidents and a trend line that points to...

In the US market, which is by far the largest for in-flight WiFi, there is a looming battle between...

Our fourth annual EFB survey report will be available from Monday January 18. The 34 page report (PDF) includes...

Inmarsat is a global connectivity provider focused on mobile connectivity solutions. They have three Ka satellites that cover the...