Viasat Inc. and China Satellite Communications Co., Ltd. announced an agreement for a strategic partnership to jointly provide in-flight...

Connectivity

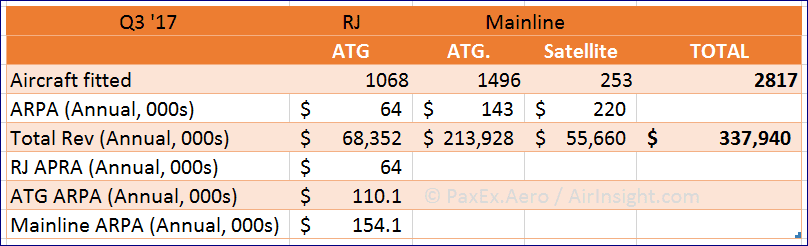

In last week’s earnings call Gogo indicated that expected service revenue for its North America Commercial Aviation segment would be...

Viasat announced a new contract with United Airlines to bring it’s latest generation in-flight entertainment and connectivity system to more than...

As we look over the technology landscape, several innovative technologies are moving from concept into production as new aircraft...

At the Las Vegas CES, Panasonic Avionics Corporation introduced a “major evolution of its satellite connectivity service” with the...

The FAA has made a 180-degree turn in its attitude towards the display of own-ship position on electronic flight...