A federal judge in Boston ruled in favor of the US Justice Department, which sued to block the proposed...

Spirit Airlines

The Airbus A319neo seems to get a huge boost from US low-cost airline Spirit Airlines. The airline plans to...

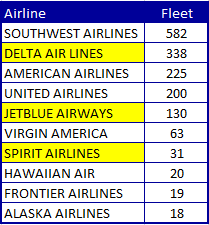

As of the 2Q18, here is where we stood with the US airline industry in-service fleet. The top four...

If one limits the active airline passenger fleet In the United States to between 100-150 seats, then as of...

Two more US Airlines have asked US authorities to reject the complaint by Boeing against the Bombardier CSeries. Spirit...

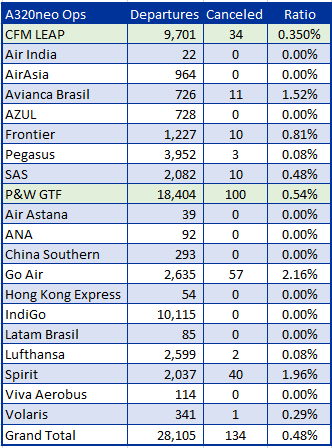

We undertook a review of A320neo flight operations. There were 71 A320neo aircraft in operation at the end of...