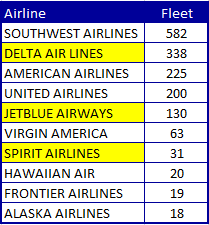

If one limits the active airline passenger fleet In the United States to between 100-150 seats, then as of...

Northwest Airlines

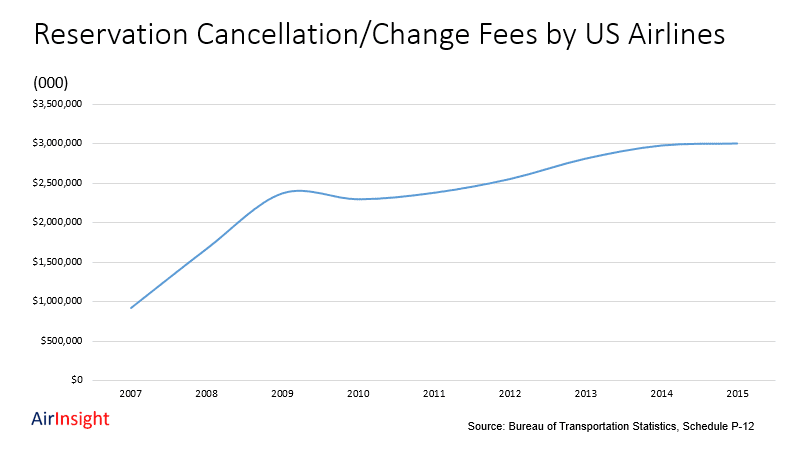

Airlines have embraced ancillary fees as a way to make up for low fares. One of those fees was...

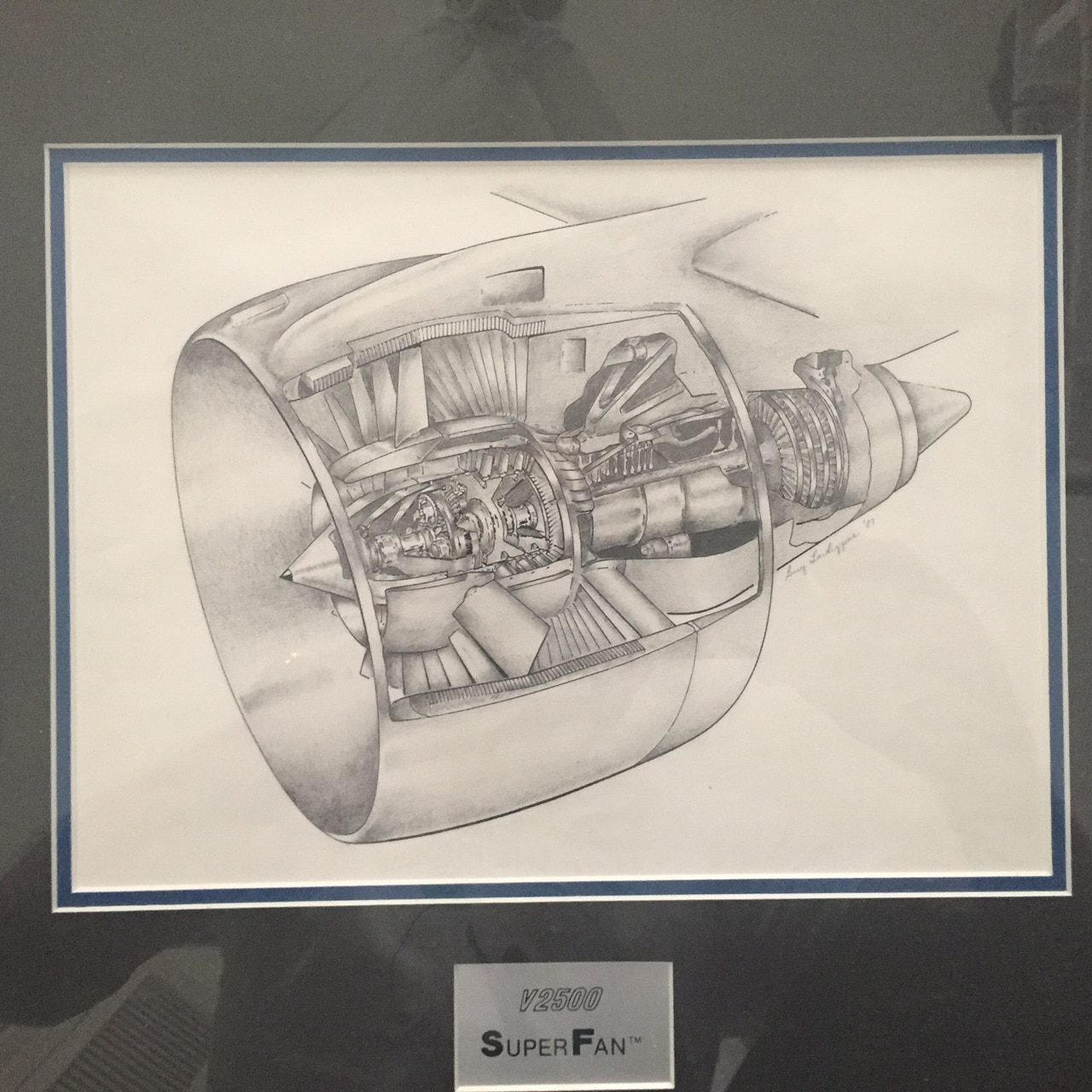

As Pratt & Whitney’s new engine starts to operate it is interesting to review its long gestation. The start...

Norwegian Air may be the first airline to issue tickets for sale for Transatlantic flights at real low cost....

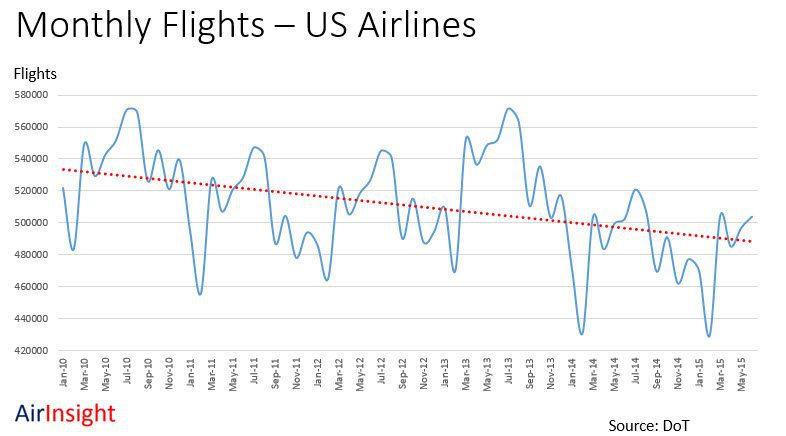

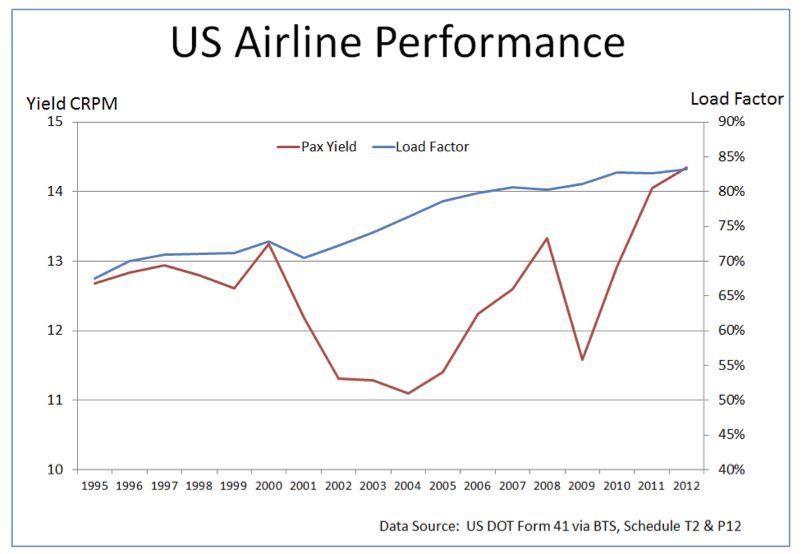

US airlines have announced record profits – load factors are at all time highs. Fares are higher than you...

The US DOJ, various state attorneys general and the District of Columbia have filed challenging the American Airlines (AA)–US...