Leasing of aircraft has taken a jump. Yet airlines prefer to buy them outright too. Richard Schuurman looks at...

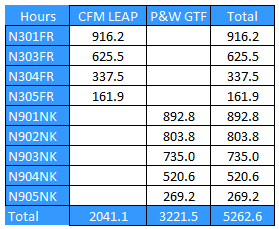

Frontier

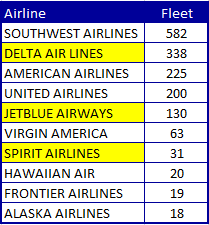

As of the 2Q18, here is where we stood with the US airline industry in-service fleet. The top four...

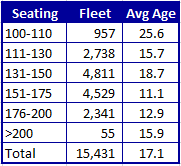

If one limits the active airline passenger fleet In the United States to between 100-150 seats, then as of...

The aerospace world is still trying to get their collective heads around the 220% number from the US Department...

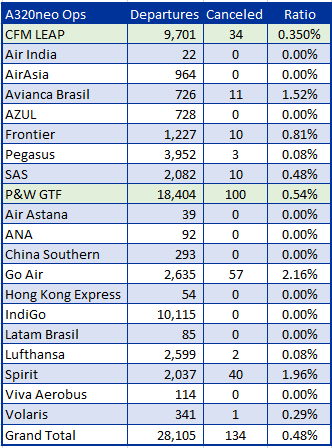

We undertook a review of A320neo flight operations. There were 71 A320neo aircraft in operation at the end of...

The A320neo has been a very popular aircraft program. Airbus has won 3,626 A320neo orders (over 5,000 neo models...