Delta Air Lines reported revenues of $13.7 billion and a net profit of $37 million in the first quarter...

Delta Air Lines

Delta Air Lines provided a vote of confidence for the A220, with an order for an additional 12 A220-300...

Delta Air Lines is set to lose its Australian partner carrier in 2022, as Virgin Australia is preparing to...

News: Delta announced yesterday that it will retire its fleet of Boeing 777 aircraft permanently after its grounding for...

Delta Airlines says its cash position is strong enough for the airline to be prepared for a negative cashflow...

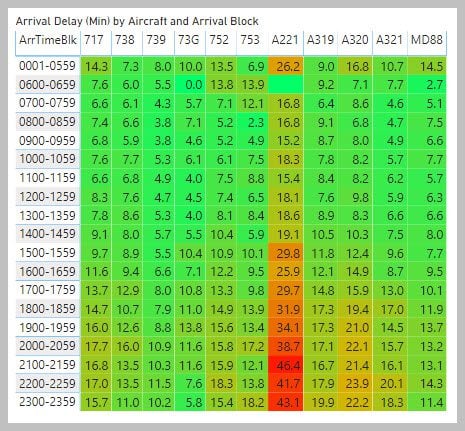

[UPDATED] With the December DoT On-Time data available we have been digging into the 2019 data. Something popped that...