The British Airways strike is costing the £40 million per day and has now entered the second of two...

British Airways

News It was 50 years ago this month that the Concorde made its first flight in 1969. With a...

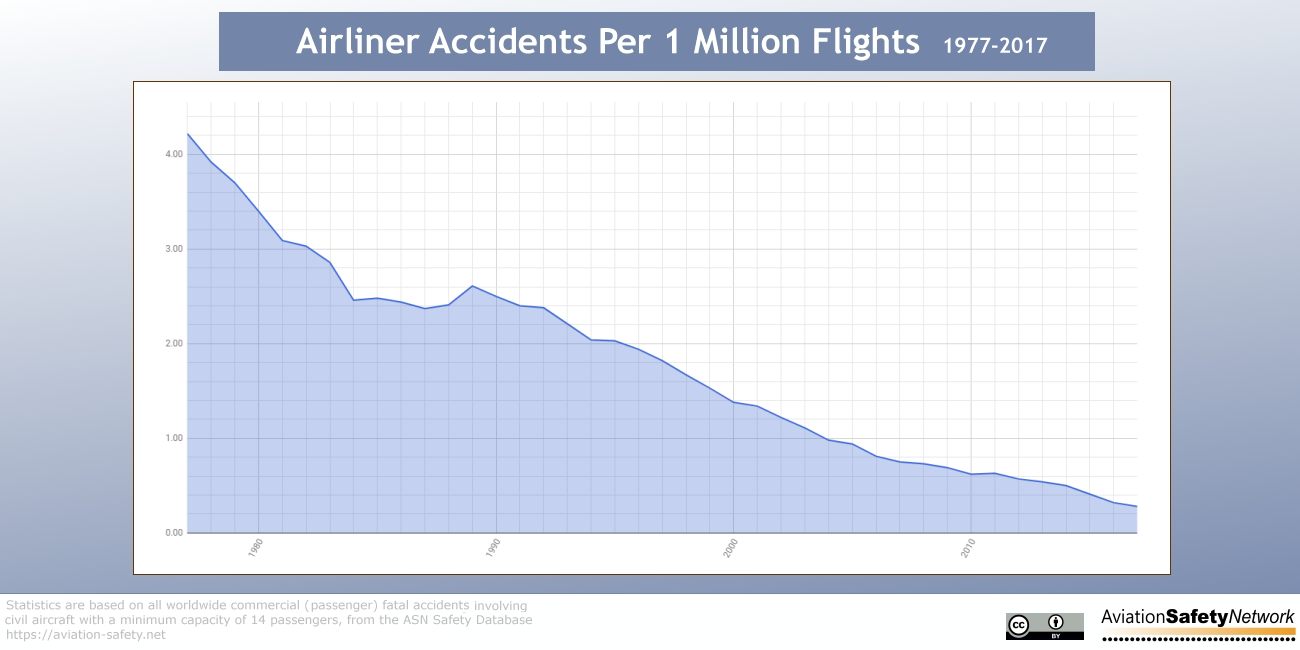

With another two stories today about in-flight component failures (Southwest, Sichuan), we are being reminded that airplanes are vulnerable. ...

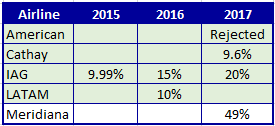

Today it emerged that Qatar Airways has bought another stake in an airline. This time it spent $662m on...

A British Airways Boeing 787-8 (G-ZBJG) was struck by lightning shortly after departure from London Heathrow on July 22nd...