News: The good news week for Boeing continues after the FAA order ungrounding the MAX in the US, as...

Alaska

The August On-Time data has been published and we note that Alaska Airlines continues to struggle to integrate the...

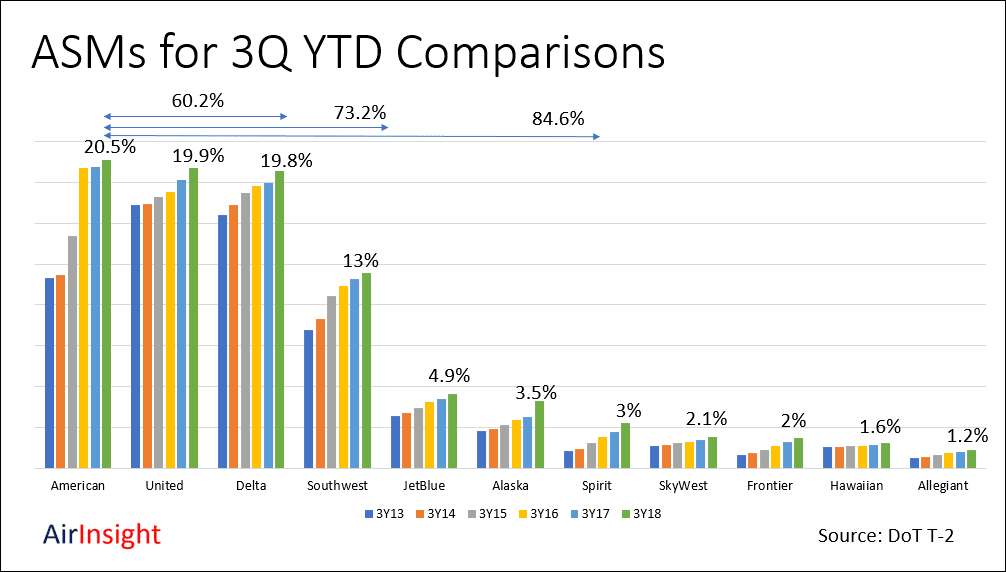

Consolidation among US airlines has seen a sharp rise in the market power of a few very big companies....

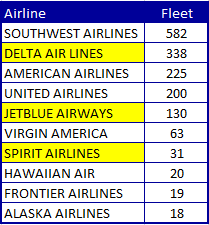

As of the 2Q18, here is where we stood with the US airline industry in-service fleet. The top four...

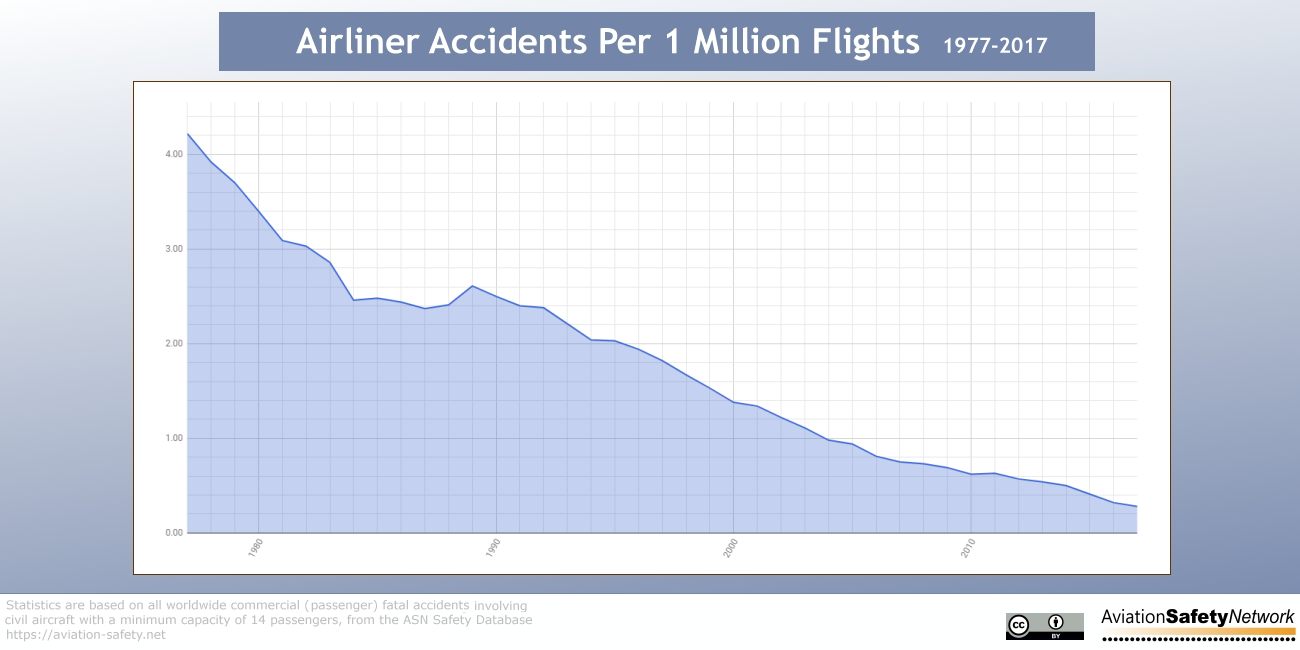

With another two stories today about in-flight component failures (Southwest, Sichuan), we are being reminded that airplanes are vulnerable. ...

If one limits the active airline passenger fleet In the United States to between 100-150 seats, then as of...