Here’s the updated model of November transactions. Subscribers can access the 14-page model. Key items: MAX8 transactions breached 300...

Aircraft

News:In the wake of the current global pandemic, airlines are sending aircraft into storage in record numbers as demand...

The global coronavirus crisis has decimated traffic and impacted airline traffic worldwide. Aircraft have been grounded worldwide, but some...

We have updated our models that use the T-2 source. However, before we get there, we want to advise...

News It was 50 years ago this month that the Concorde made its first flight in 1969. With a...

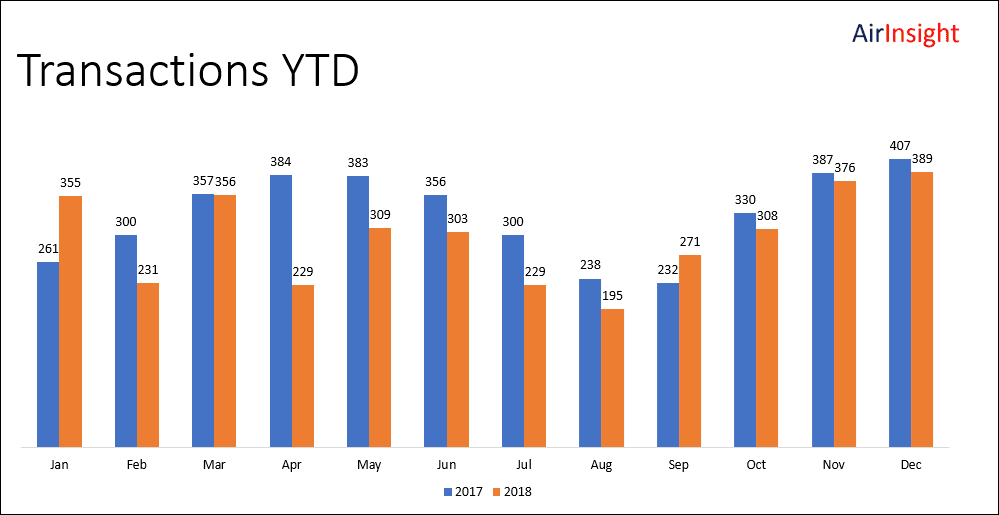

With December 31 receding into history, it is time to review the sales and deals (transactions) from 2018. The...