Boeing claimed a victory from the latest round of WTO rulings – Airbus, of course, differed in their interpretation. ...

UTC Aerospace Systems

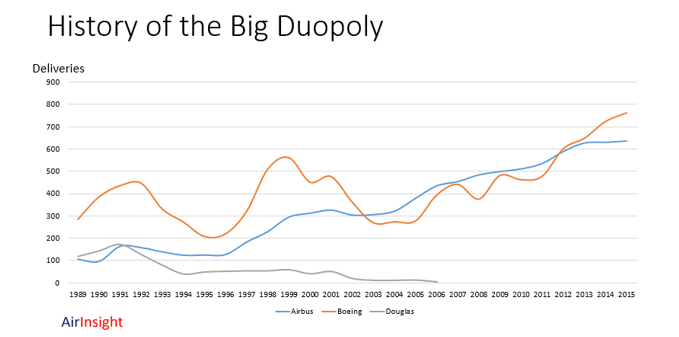

The biggest commercial aerospace industry story revolves around Airbus and Boeing and how they compete vigorously for every order....

Many in the west have pooh-poohed Russian aviation, despite the Sukhoi Superjet being a credible competitor, doing well with...

On Tuesday we had an opportunity to speak with John Saabas, President of Pratt & Whitney Canada. While our...

UTC Aerospace Systems was created four years ago when UTC acquired Goodrich Aerospace and merged it with Hamilton Sundstrand. ...

In this video, we interview Tim White, President of Electric Systems at UTC Aerospace Systems to discuss the trend...