It has not been a good year for Superjet. First, it was the news from Mexico, where Interjet is...

Superjet

AirInsight has published its latest aircraft program analysis, this one covers the IRKUT MC-21 program. Several months in development,...

[Updated update] FlightGlobal now reports that indeed some SSJs are being phased out at Interjet. We just received a...

[UPDATED] The SSJ program is taking a hit as their launch western customer has decided to sell its fleet...

There is a fascinating story out today about Mexico’s Interjet and their aircraft vendor. The near $40m in compensation...

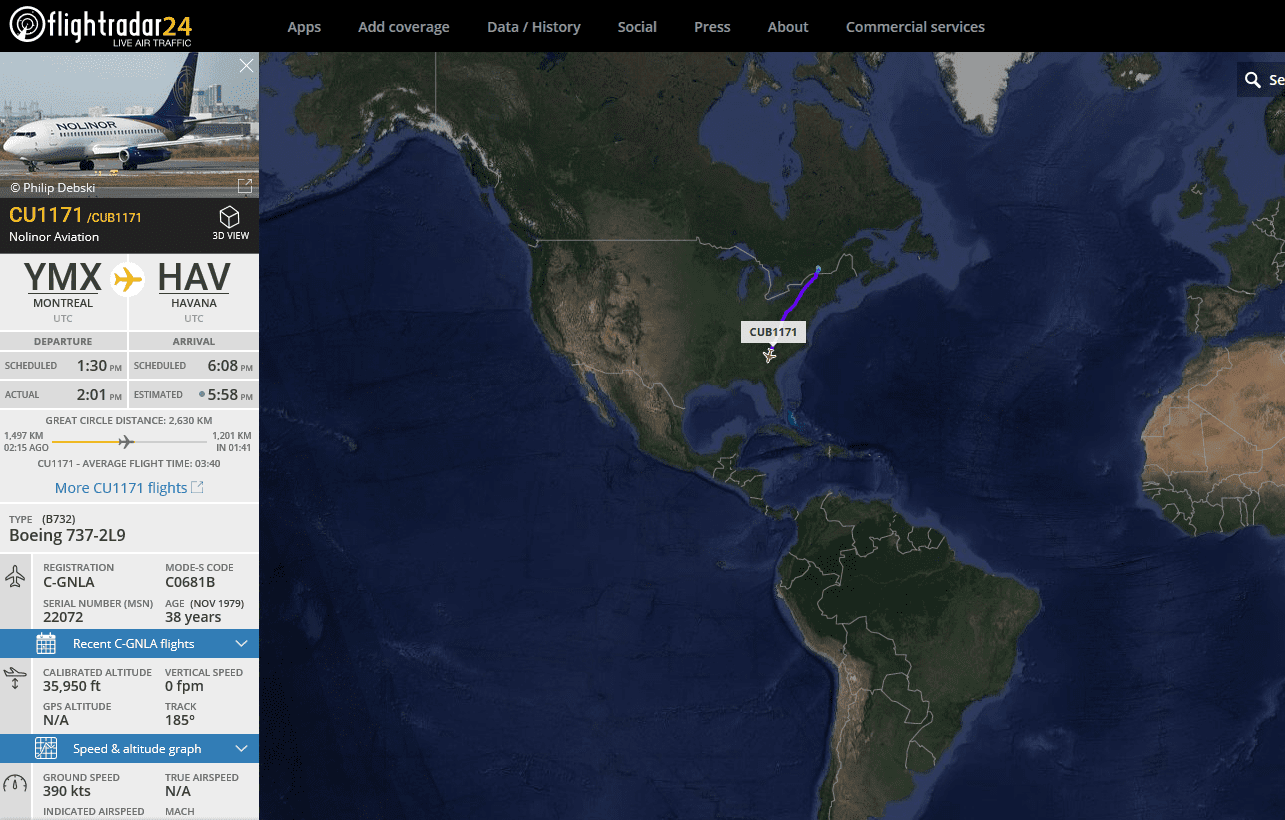

Please start with this story. This is rather alarming news. We did a quick search on FlightRadar24 to see...