In 2016, NASA announced its X-57 project. Then in June 2023, the project was canceled without a single test...

SAAB

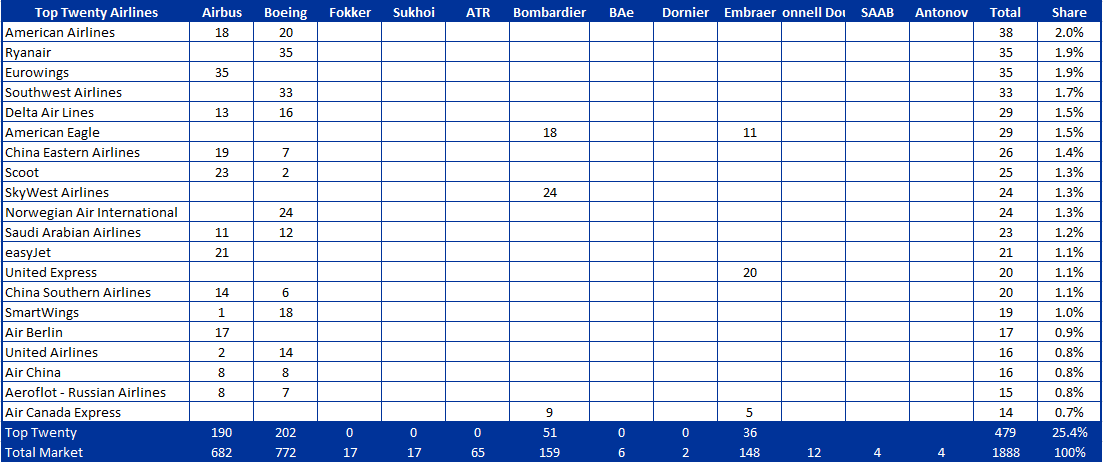

Boeing’s interest in Embraer is self-evident. This interest goes back a long time. There are deep relationships between high-level...

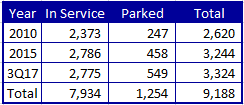

Turboprops have had a good year in 2017. We take a look at the market and provide some insights...

Despite the slower activity at air shows, the commercial aircraft business is not moribund. There has been quite a...

It has been a long time since ATR made a sale in the USA. But today they got great...

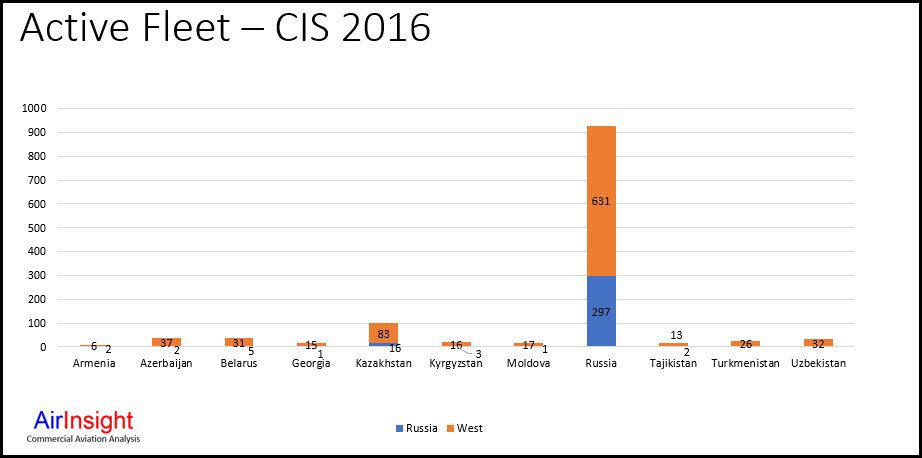

[UPDATED] One of the primary reasons the Russia state decided to merge its various aerospace companies was to ensure...