In our previous story, we looked at the big picture of relative fleet size and age. Now we dig...

Douglas

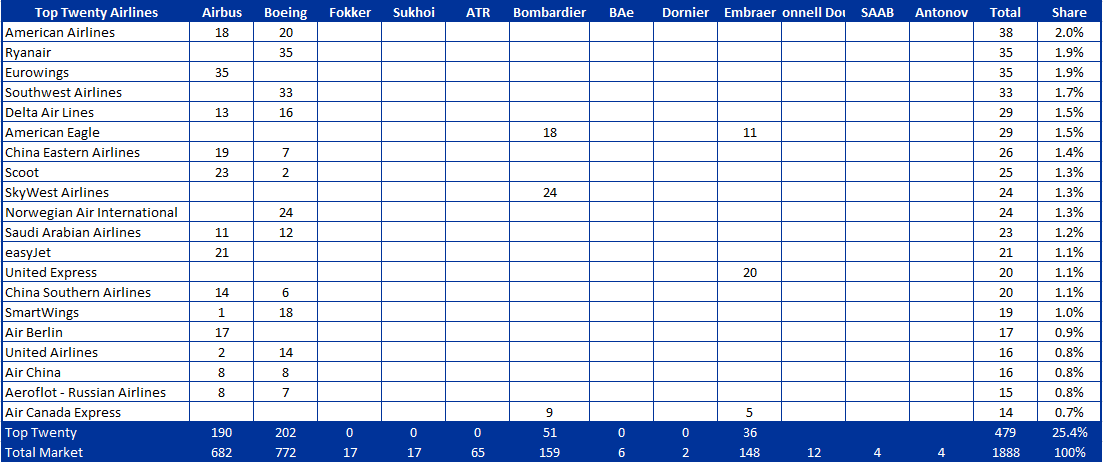

There are claims every year about who’s the biggest in the business. Since everyone wants to be a winner,...

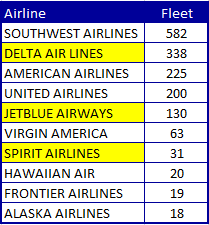

If one limits the active airline passenger fleet In the United States to between 100-150 seats, then as of...

Despite the slower activity at air shows, the commercial aircraft business is not moribund. There has been quite a...

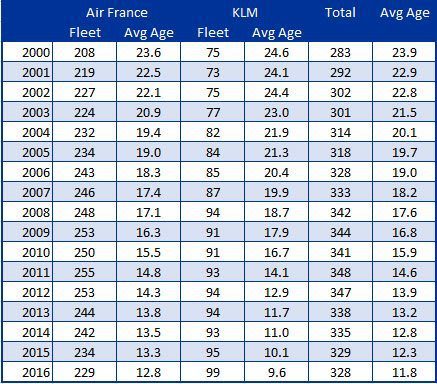

Air France and KLM merged in 2004. The joint company has hubs in Amsterdam and Paris. Because of their...

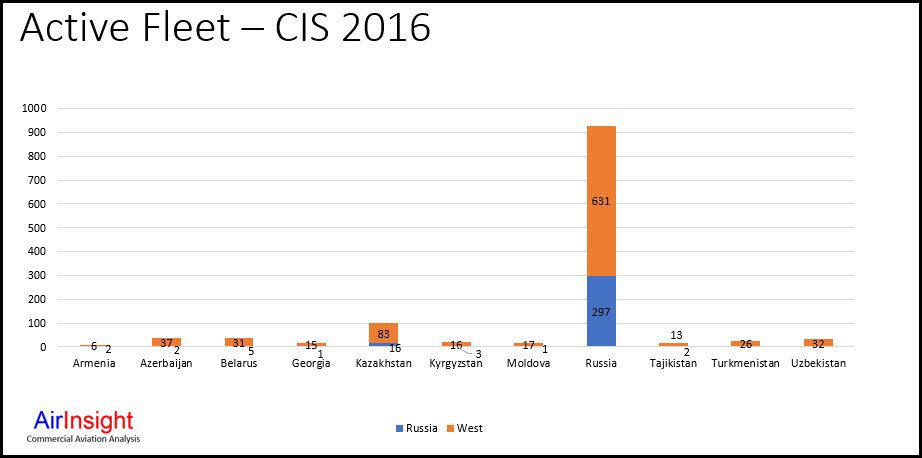

[UPDATED] One of the primary reasons the Russia state decided to merge its various aerospace companies was to ensure...