News is emerging from Asia that Air China has ordered 100 C919s in a deal valued at $10.8 billion...

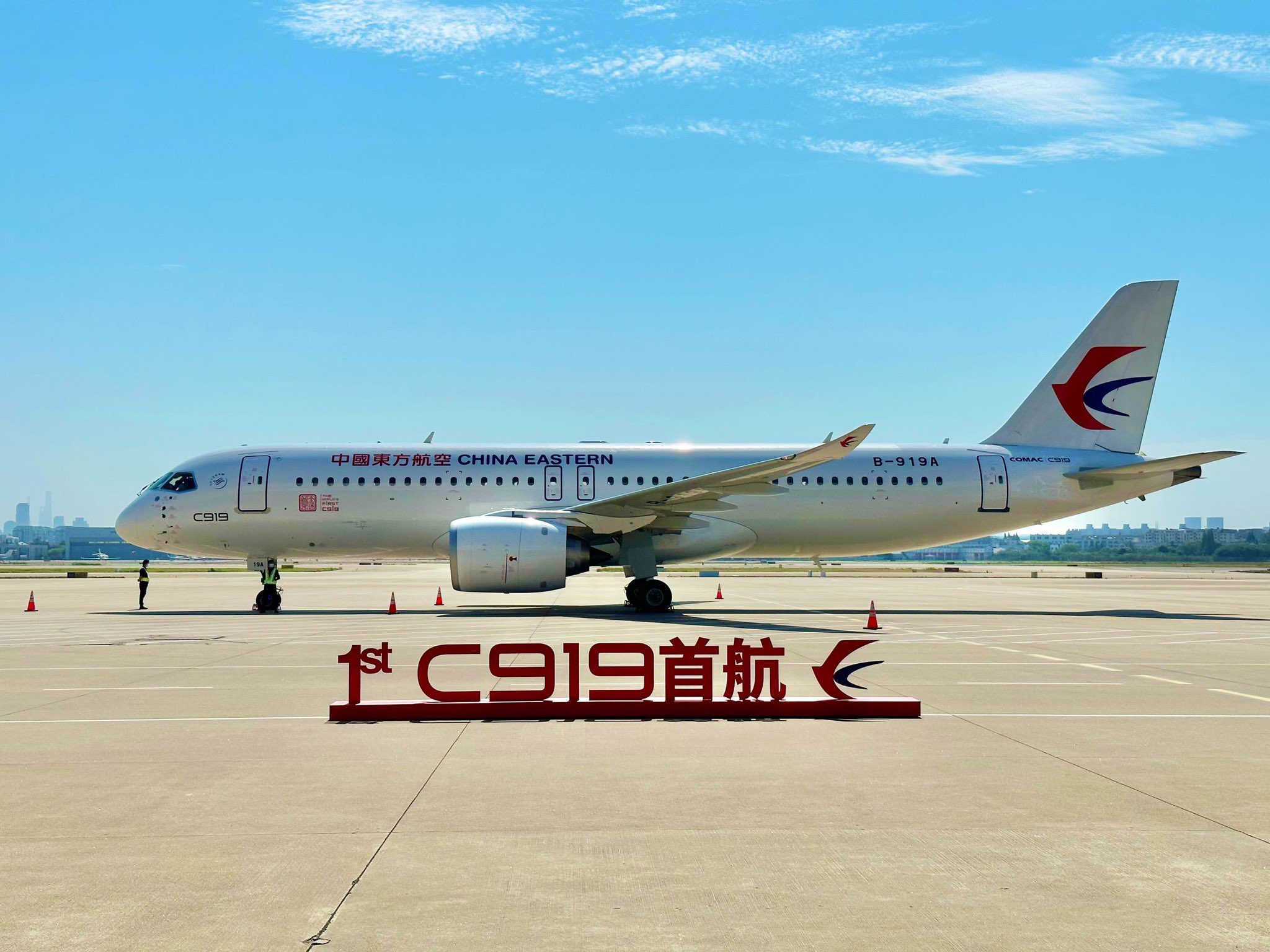

COMAC

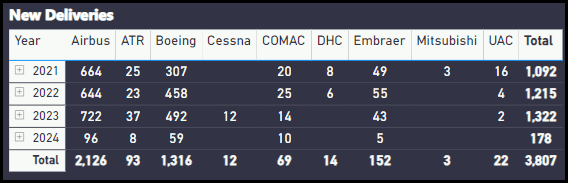

China is the second-largest commercial aviation market, making it a critical bellwether. The grounding of the MAX played havoc...

Several articles from the recent Singapore show said COMAC was on the move, and the duopoly was under some...

Boeing has commenced the Singapore Airshow with substantial orders from Thai Airways and Royal Brunei Airlines for the Boeing...

A South China Morning Post report describes COMAC’s growing ambitions. The key language is: “…promote the certification of its...

Air China intends to place an order with COMAC for 11 ARJ21 regional aircraft and six C919s, it said in...