Allegiant Travel Company just announced its proposed transaction to acquire ten A319s from Cebu Pacific Air has been terminated...

Month: December 2012

It is unusual to get so much news from the company. Two releases in two days. Yesterday we heard...

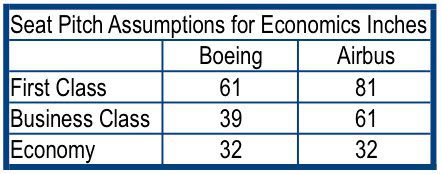

In the wake of Airbus “Pinocchio” advertisement critical of economic claims by Boeing, AirInsight has decided to take an...

The large twin-engine, twin-aisle competition for the future is gaining momentum following the opening of the Airbus A350 Final...

While many in the industry view the COMAC 919 as China’s aerospace learning vehicle that will enable it to...

Passing through the fifth anniversary of the A380, we spoke with Mary Ellen Jones, President of Engine Alliance about...