AirInsight looks back on the highs and lows in commercial aviation in 2011, all in no particular order. HIGHS...

Month: December 2011

Philippe Poutissou is VP, Marketing at Bombardier Commercial Aircraft and he spent some time talking with us about next...

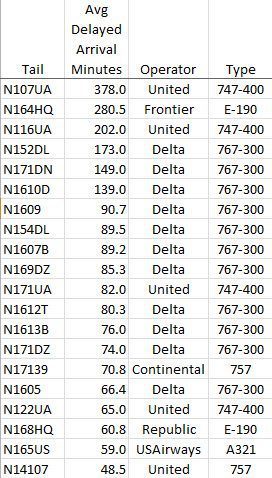

An aspect of the DoT On-Time data is arrival delays by tail number. Between January and October 2011 there...

Barry Eccleston is Airbus Americas CEO and spent over fifteen minutes talking about the great year they had plus...

Randy Tinseth is vice president, Marketing, for Boeing Commercial Airplanes and kindly agreed to podcast with us looking forward...