The reaction to American’s recent fleet order was not positive from the financial analyst community. They have valid concerns...

Month: July 2011

Resin transfer injection (RTI) is about to join resin transfer molding and composite layup as a construction technique used...

Now that Boeing has elected to follow Airbus and proceed with the re-engining route for its single aisle jet,...

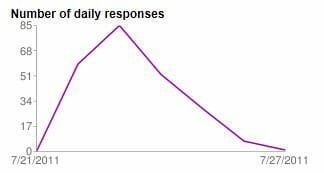

As the chart illustrates, the survey has pretty much run its course. As of this writing, we have 233...

Two senators wrote to Richard Anderson, CEO of Delta Air Lines and chairman of the Air Transport Association. The...

Kestrel Aircraft has chosen the Honeywell TPE 331-14 engine for its new turboprop aircraft currently under development. Kestrel is...